Healthcare equipment technology advances move quickly. If you walk into a patient room today, you will see equipment that didn't exist a decade ago. For hospitals and ambulatory surgery centers (ASCs) the decision to replace aging equipment is no longer about waiting for something to break. It is a strategic calculation that involves patient safety, financial health, and staying competitive in an increasingly digital landscape.

This post will unpack:

Why Aging Medical Equipment Presents a Problem

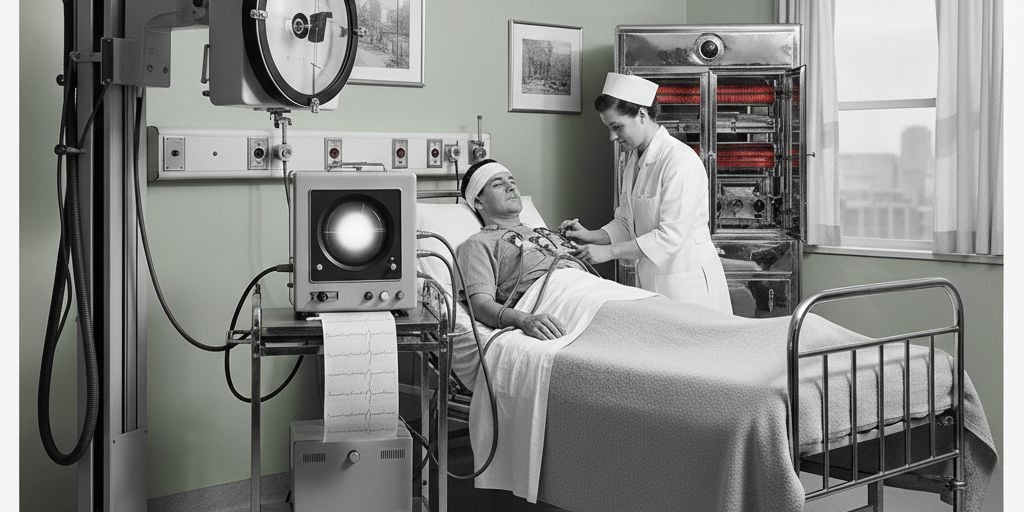

The rapid advancement of healthcare technology is driving a significant shift in how medical facilities approach equipment investments, with innovations like AI-powered diagnostics and telemedicine tools becoming essential for care delivery.

At the same time, many ASCs and hospitals are facing the challenge of replacing aging medical equipment that can no longer meet performance, safety, or regulatory standards.

This convergence of innovation and necessity accentuates the importance of updating older devices to improve patient outcomes, streamline workflows, and maintain competitive, high-quality care.

The healthcare landscape is dominated by two themes: Interconnectedness and Intelligence.

The Rise of AI-Integrated Hardware

There is a shift happening where equipment is no longer a "dumb" tool. AI is now embedded directly into the hardware. For example, it is increasingly common for imaging systems to use AI to auto-center patients or highlight potential abnormalities in real-time. Facilities are replacing aging equipment specifically to access these "smart" features that reduce the cognitive load on clinicians.

The "Site-Neutral" Migration

CMS updates continue to push more procedures - including complex musculoskeletal and cardiac cases - into the ASC environment. This trend is forcing ASCs to buy "hospital-grade" equipment like advanced cardiac monitors and high-capacity sterile processing systems to manage the increased acuity and volume.

Sustainability and the Circular Economy

More facilities are looking at the environmental impact of their equipment. There is a growing trend toward "refurbished" high-end equipment from certified OEMs. This approach offers a way to access current technology at a lower price point while keeping perfectly good chassis out of landfills.

What is the Cost of Waiting?

It could be said the most dangerous phrase in healthcare management is "we've always done it this way." While capital preservation is important, the goal of any medical facility is to provide the highest standard of care, efficiently. Aging equipment is an anchor that can impede the efficiency of clinical teams and by extension financial performance.

When Should Aging Medical Equipment be Considered for Replacement?

The impulse to "make it last one more year" is strong, especially when capital budgets are tight. However, holding onto legacy systems can cost more than the upgrade itself. Aging medical equipment should be replaced when a thoughtful cost evaluation shows that ongoing repairs, downtime risk, and lost efficiency are more expensive than investing in newer, more reliable technology - ideally before it breaks.

Consider these three points to begin the process of identifying when medical equipment should be replaced:

The Cost of Downtime vs. Capital Outlay

Aging equipment is notorious for "hidden" costs. For example, every hour a single central steam sterilizer supporting one OR block and clinic instruments can cause $3000-$5,000 a day in lost revenue + an additional $1,000 - $2,000/day in extra costs. In the ASC world, where high throughput is the engine of profitability, a single day of high-impact equipment failure can wipe out a month’s margin.

Clinical Outcomes and Patient Safety

Newer technology often includes features that reduce human error. For example, anesthesia machines these days are equipped with advanced ventilation modes that are much more responsive to patient needs than models from the early 2010s. If medical equipment lacks the precision required for the higher-acuity cases now moving to the outpatient setting, a replacement is a safety mandate, not a luxury.

Physician Recruitment and Retention

Surgeons want to work with the best tools. If a hospital down the street offers robotic-assisted platforms or 4K visualization and you are still using 1080p monitors, you risk losing your top talent. Equipment is a primary driver for where surgeons choose to bring their cases.

How Should Aging Medical Equipment be Evaluated for Replacement?

Aging medical equipment should be evaluated for replacement using a structured approach that balances clinical impact, financial considerations, and operational risk.

Before finalizing that purchase order, it’s important to step back and consider the bigger picture by answering several questions.

Market Demand Analysis

Is there a genuine demand for the services this new equipment facilitates? If you are buying a $2 million robot, do you have the surgeon volume to break even within three years? Use data, not just "gut feeling," to justify the spend.

Total Cost of Ownership (TCO)

The retail price is just the beginning. Consider:

- Is the maintenance affordable?

- Does the machine require proprietary disposables that cost five times more than the generic versions?

- How many hours of staff time will be lost during the transition?

Future-Proofing and Compatibility

Can the new equipment "talk" to the existing Electronic Health Record (EHR)? In 2026, data silos are a major operational bottleneck. If the new equipment doesn't support current interoperability standards like FHIR, it will be obsolete before the warranty expires.

Space and Infrastructure

ASCs must be wary of "footprint creep." Does the new equipment require additional space or infrastructure modifications? A miscalculation here can lead to expensive facility renovations that weren't in the budget.

By taking a proactive, data-driven approach to equipment replacement, facilities can position themselves as leaders in the community. Environments are created where surgeons want to work, and more importantly, where patients feel safe and well-cared for.

What Medical Equipment Is Replaced Most Frequently?

With the safety, financial, and competitive pressures reshaping how care is delivered, the conversation naturally turns from why equipment replacement matters to which assets deserve the most immediate attention.

Not all medical equipment ages at the same pace. Some systems reach the point of replacement far sooner because of daily clinical demands, regulatory changes, or rapid innovation. Identifying the equipment that most frequently requires upgrading helps leaders prioritize investments that protect patient safety, support staff efficiency, and sustain long-term operational performance.

Although not exhaustive, here is a look at the medical equipment most frequently included in replacement budgets.

|

Equipment |

Life Cycle |

Cost Tier |

Key Reason for Replacement |

|

Patient Monitors |

7-10 Years |

Medium |

Technology obsolescence, unsupported software, declining reliability, and inability to integrate with newer clinical systems. |

|

EKG Machines |

7-10 Years |

Low-Medium |

Wear on internal electronics, outdated data connectivity, and lack of compatibility with EHR and telemetry systems. |

|

Ultrasound Probes |

3-5 Years |

Low |

Physical wear, image degradation, cable failure, and infection‑control risks due to micro‑tears and seal breakdown. |

|

Endoscopes and Scopes |

5-7 Years |

Medium-High |

Optical degradation, mechanical wear, costly repairs, and increasing infection‑control and reprocessing risks. |

|

Surgical Power Tools |

5-7 Years |

Medium |

Mechanical fatigue, battery degradation, reduced precision, and increased maintenance costs impacting surgical efficiency. |

|

Anesthesia Machines |

10-15 Years |

High |

Obsolete software/hardware, limited manufacturer support, compliance gaps, and reduced patient safety features. |

|

C-Arms/Mobile X-Ray |

10-12 Years |

High |

Imaging quality decline, radiation dose inefficiency, software obsolescence, and high service costs. |

|

Sterilizers and Autoclaves |

10-15 Years |

Medium High |

Mechanical wear, cycle inconsistencies, failure to meet evolving sterilization standards, and increased downtime. |

|

Defibrillators |

8-12 Years |

Medium |

Battery failure risk, outdated resuscitation |

Cost Tiers: Low = <$25K; Medium = $25K-$250K; High = >$250K

Partner with CME Corp to Replace Aging Medical Equipment

Replacing aging medical equipment is a strategic decision that can impact the quality, efficiency, and safety of patient care for years to come. Partnering with CME Corp., specialists in capital healthcare and life sciences equipment, can help ensure you are purchasing equipment that not only conforms to today’s demanding healthcare environments but also positions you for the future.

CME Account Managers are healthcare and laboratory equipment experts. Their expert guidance can help you evaluate healthcare products and their features, so you select the equipment that best aligns to your needs. And, with CAD-based layout and design services our sales team can offer you the advantage of confirming the replacement medical equipment will fit seamlessly in the available space.

Our relationship with over 2,000 manufacturers positions us to be ready with alternative product recommendations that do not compromise function or performance. when the frustrating reality of supply chain challenges or budget constraints hit.

In addition to CAD-based layout design services, we offer end-to-end integrated services that set us apart as the nation’s premier specialty distributor of equipment used in healthcare.

CME employed direct-to-site delivery and installation teams (DTS) have been trained by the manufacturers we work with and are experts in the set-up of healthcare equipment.

Professional in-house project management teams support our DTS services with centrally managed logistics, warehousing, staging, and assembly that lay the foundation for delivery that raises the bar on excellence - regardless of whether the equipment is being purchased through CME or directly from the manufacturer.

Rounding out our comprehensive offering of services complementing our healthcare equipment expertise are CME employed Biomedical Equipment Technicians (BMETs). We are available help in-house BMETs with equipment check-in, asset tagging, the preventive maintenance and repairs that prolongs the service life of equipment.

![]() Click CHAT to begin the conversation about replacing your aging medical equipment assets still in service

Click CHAT to begin the conversation about replacing your aging medical equipment assets still in service

About CME: CME Corp is the nation’s premier specialty distributor of healthcare and laboratory equipment. We partner with over 2,000 manufacturers to offer more than 2 million products across healthcare, laboratory, pharmacy, and research sectors. In addition to an extensive product portfolio, we also offer project management, CAD design, warehousing, logistics, consolidated direct-to-site delivery, and biomedical and technical services, all staffed by CME employees. Our mission, to help healthcare facilities nationwide reduce the cost of the equipment they purchase, make their equipment acquisition, delivery, installation, and maintenance processes more efficient, and help them seamlessly launch, renovate, or expand on schedule, is supported by 25 service locations strategically located across the country.